The story of money is as old as civilisation itself. From shells to metal coins, from paper notes to digital wallets, humanity has always searched for faster, safer, and more efficient ways to exchange value. Today, the financial world is witnessing another transformation with the rise of central bank digital currencies, better known as CBDCs. Among all nations experimenting with this new form of money, one small island country has quietly taken the lead and set a global example. The Bahamas, famous for its turquoise waters and thriving tourism, has become a pioneer in central bank digital currency innovation, making it the first nation to officially launch a fully operational CBDC called the Sand Dollar.

The Birth of the Sand Dollar

In 2020, The Central Bank of The Bahamas launched the Sand Dollar, making history as the first country in the world to issue a nationwide central bank digital currency. Unlike cryptocurrencies such as Bitcoin, which are decentralised and volatile, the Sand Dollar is a state-backed digital currency tied to the Bahamian dollar, which itself is pegged to the US dollar. This ensured stability and trust right from the start.

The name Sand Dollar was chosen to connect the digital future of finance with the cultural heritage of the islands. Sand dollars, the flat sea urchins found along Bahamian beaches, represent value and natural beauty. By naming its CBDC after this symbol, the government made sure the technology felt relatable to its people rather than something distant or overly technical.

Why The Bahamas Took the Lead

The decision to launch a CBDC in The Bahamas was not made just for prestige. The island nation faced a very real challenge. Many of its citizens lived on far-flung islands where access to banking services was limited. Traditional banks often found it uneconomical to operate in remote areas with small populations. This left thousands of Bahamians without easy access to financial services, forcing them to travel long distances or rely on cash for daily needs.

The Sand Dollar was designed to solve this problem. By offering a secure, digital alternative accessible via mobile phones, the government brought financial inclusion to people who had never held a bank account before. A fisherman in a remote settlement could now receive payments instantly. A shopkeeper could accept digital money without installing expensive infrastructure. For the first time, modern financial tools reached every corner of the archipelago.

How the Sand Dollar Works

The Sand Dollar functions like regular money but in a digital form. Citizens can download an e-wallet app, register with a verified ID, and top up their digital wallets through authorised institutions. Payments can be made by scanning QR codes, transferring funds peer-to-peer, or paying merchants directly. Transactions happen instantly and securely, supported by the Central Bank of The Bahamas.

Limits are placed on wallet balances to prevent misuse, and strong security measures protect users against fraud. Unlike cryptocurrencies, which can fluctuate wildly in value, the Sand Dollar remains equal to the Bahamian dollar, ensuring stability. This makes it a practical currency for everyday transactions rather than a speculative investment.

Global Significance of The Bahamas’ Move

The Bahamas may be a small country, but its step into CBDC innovation has global significance. Larger economies like China, the European Union, and India are experimenting with digital currencies, but The Bahamas has already implemented one. By being the first mover, the country has gained valuable insights into what works and what challenges arise in the real-world adoption of CBDCs.

This bold experiment has positioned The Bahamas as a thought leader in global finance. Central banks around the world are closely watching the project, learning from its successes and difficulties. The Sand Dollar has also been recognised by international organisations like the International Monetary Fund as a case study in financial innovation.

Benefits of the Sand Dollar

The advantages of the Sand Dollar go beyond financial inclusion. Several benefits stand out:

- Convenience: People can send and receive money instantly without waiting for banks to open or dealing with long queues.

- Resilience: In times of natural disasters such as hurricanes, when physical banking services are disrupted, digital payments can still function if mobile networks remain active.

- Cost Efficiency: For the government and private sector, reducing reliance on cash lowers printing, storage, and transportation costs.

- Security: Digital money reduces risks of theft or loss compared to carrying physical cash.

- Data Insights: Transactions made in digital form allow better monitoring of economic activity, helping policymakers design targeted solutions.

Challenges and Criticisms

While the Sand Dollar is groundbreaking, it has not been without challenges. One issue is adoption. Despite the convenience, some Bahamians remain hesitant to switch from cash, especially older citizens unfamiliar with digital tools. Educating the population about how to use the e-wallet and ensuring trust in digital transactions remain ongoing tasks.

Another concern is cybersecurity. Any digital system is vulnerable to hacking attempts, and critics argue that state-backed currencies could become targets for cybercriminals. The Central Bank of The Bahamas has invested heavily in security infrastructure, but constant vigilance is necessary.

There are also global concerns about privacy. CBDCs can potentially allow governments to monitor individual transactions more closely, raising debates about balancing financial transparency with personal freedom.

The Bahamas as a Model for Other Nations

Despite these hurdles, The Bahamas has created a model for how small countries can lead in technological innovation. Larger nations often move slowly due to their size and complexity, but The Bahamas showed that being small can be an advantage. Quick decision-making, focused goals, and a clear vision allowed the island nation to leap ahead.

Countries with similar challenges, such as limited banking access or geographically dispersed populations, are studying the Sand Dollar closely. The Caribbean region, in particular, is exploring how digital currencies can improve trade and remittances. Even major economies are considering how to replicate the lessons from The Bahamas on a larger scale.

The Future of CBDCs

The Bahamas’ experience is only the beginning of the global CBDC journey. Already, over 100 central banks worldwide are researching or developing digital currencies. China’s digital yuan is being tested across major cities, while the European Central Bank is considering a digital euro. India has rolled out pilot projects for the digital rupee.

The Sand Dollar, however, holds the distinction of being first and functioning in a real-world economy. This achievement ensures The Bahamas a permanent place in financial history. As more countries adopt CBDCs, we may see greater cross-border cooperation, standardisation, and even integration between digital currencies.

A New Era of Financial Inclusion

Perhaps the most powerful impact of the Sand Dollar is its role in financial inclusion. By enabling citizens to participate in the digital economy regardless of their location, income level, or access to banks, The Bahamas has redefined what financial equality can look like.

This model has the potential to reshape global finance. If CBDCs are implemented thoughtfully, they can ensure that no one is left behind in the digital age. For rural communities, migrant workers, and small entrepreneurs worldwide, digital currencies may open doors that were once shut by traditional banking systems.

Storytelling from the Ground

Consider the story of Maria, a small shop owner on one of the outer islands. For years, she relied entirely on cash because the nearest bank branch was hours away by boat. Handling money was a daily struggle, and theft was always a risk. Since adopting the Sand Dollar, Maria can now accept digital payments from tourists and locals alike, transfer money to suppliers instantly, and even save securely in her e-wallet. For her, this innovation is not just about technology but about dignity, security, and opportunity.

Similarly, fishermen, farmers, and local artisans across the islands are benefiting from the new system. These personal stories reflect the true value of digital currency beyond technical jargon.

Global Reactions

The launch of the Sand Dollar was welcomed by financial experts worldwide. Some praised it as a bold move that put The Bahamas on the map of financial innovation. Others questioned whether larger economies with more complex financial systems could follow the same path. The International Monetary Fund and the World Bank have closely monitored the project, offering both support and caution.

Tech companies have also shown interest. Digital wallets, fintech platforms, and mobile banking services are eager to integrate with CBDCs, seeing them as the next frontier in financial technology. The Bahamas has positioned itself as a testing ground for how public and private players can collaborate in digital finance.

Pioneering CBDC Regulations

Currently, commercial banks through the BOJ which is headed by Governor John Rolle are reportedly to be subjected to regulations that would compel them to make Sand Dollar available. This move will seek to trigger adoption in within two years’ time. Bahamas’ CBDC project is leading interest from over 130 countries considering a central bank digital currency.

Sand Dollar: A Slow Start.

Implementation of Sand Dollar is still weak many years after its seemingly revolutionary debut. Present data reveal that it represents no more than 0.8 percent of the total amount of money existing in the world. Mobile money transactions went down in terms of wallet top-ups from $49.8 million to $12 million in the eight months to August 2023.

Commercial Banks: New Life Change

The new regulation will create pressure for acquiring new IT systems in the banks. This has been regarded as the move from the “carrot to stick” strategy of pushing forward the CBDC and mobile payments. The authorities of banks around the globe have revealed some worries regarding possible deposit flight that may be caused by CBDCs.

Global CBDC Landscape

Central banks are literally running towards CBDCs and 130 plus countries are either conducting research or experimenting with it. The ECB is currently intending to make the use of digital euro mandatory for merchants and banks. Still, the Bahamas continues to be an example of leading implementation.

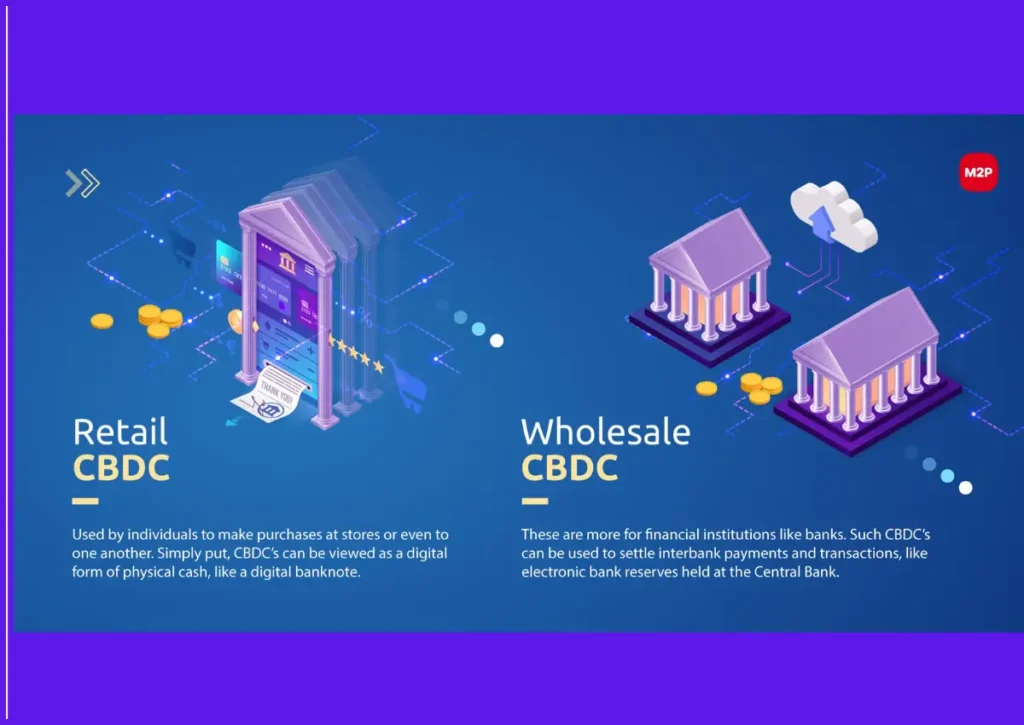

CBDC Types: Retail Vs Wholesale

CBDCs come in two forms: gross (retail or public use) and net (wholesale that is the financial institutions only). The Sand Dollar is in the category of retail, as it provides the general public with onward access to digital central bank money.

Mobile Payments: Key Driver

Promoting CBDC will increase the usage of mobile payment consistent with the general objective. It has the potential of transforming financial services in the context of the island nation and the ways of carrying out transactions.

Looking Ahead

The journey of the Sand Dollar is still unfolding. Adoption rates continue to grow as awareness spreads, and partnerships with fintech companies are making the currency easier to use. Over time, as more citizens adopt digital payments, The Bahamas could become one of the most financially inclusive societies in the world.

The real revolution lies not just in launching a digital currency but in building an ecosystem where it becomes part of everyday life. The Bahamas is showing the world how that can be achieved.